Missouri Leads the Way on Right to Refuse Bills

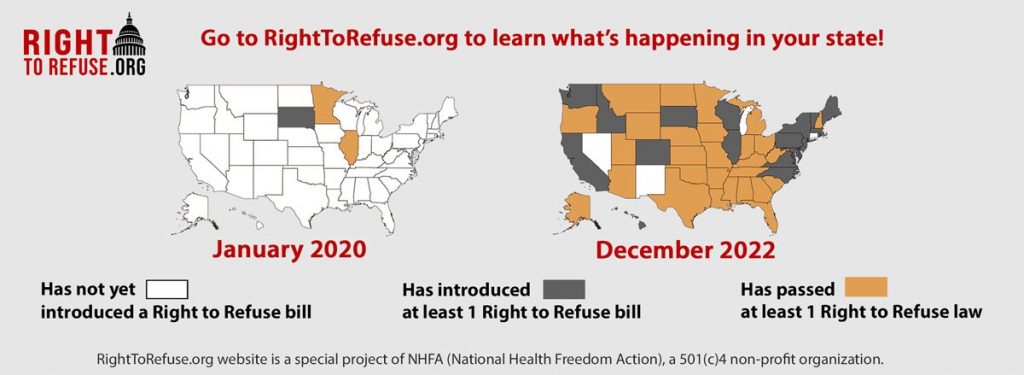

In just the past two years, across the nation 71 Right to Refuse bills have passed in 27 states, and 72 bills are now pending in 10 states. These laws take different approaches, but all are steps towards health freedom and the right to refuse unwanted vaccinations, masking, and other restrictions. As we get ready for a new year, and many state legislatures are gearing up for new sessions, Missouri is leading the way in newly-introduced Right to Refuse bills with a total of seven, all prefiled on December 1. Most of the bills filed offer multiple forms of protection against unwanted vaccinations, and many address testing.

Resolution to Amend State Constitution

Leading the way is SJR20, a Resolution that would put a proposal to amend the state constitution to the electorate. This amendment would prohibit any law or policy by public entities, including schools and universities that receive public funds, which infringes on the right to refuse any medical procedure, including vaccinations.

No School or University Mandates, No Forced Testing

Most of the proposed new laws include protection for children and college students. SB159 is a broad bill that would prohibit schools and universities from requiring any student or employee to receive a COVID-19 vaccine or gene therapy. COVID-19 testing would only be allowed with the consent of an employee, student, or parent. Persons who violate the law may be fined up to $5,000 and have any state licenses revoked. Civil actions for physical, mental, or emotional injury are allowed.

Conscientious Belief Exemptions Must Be Honored

SB232 would limit the vaccinations that the state health department may require for school attendance to those listed in the bill. It would also remove a vaccination mandate for private schools. And public-school students may attend without an immunization if they have acquired immunity. The bill also adds conscientious belief to exemptions from vaccination, and if parents provide a written statement, the exemption must be approved. Not vaccinating children shall not be considered child abuse, and doctors may not be disciplined for providing an exemption statement. More narrowly, SB99 would exclude COVID-19 immunizations from the list of childhood immunizations required day care, preschool, public, private, parochial, or parish schools.

No Public Funds for Entities that Require COVID-19 Vaccine; Exemptions

Another example of a broad bill, SB201 states that no public or private entity receiving public funds, or any other public accommodation, shall require documentation of a COVID-19 vaccination to access transportation systems, facilities, services, or public accommodations. It also says that no preschool, school, or public university may require COVID-19 vaccination or testing prior to 2028. And employers shall grant exemption to any COVID-19 vaccine requirement for philosophical and religious beliefs, or for prior COVID-19 recovery and may not require testing as alternative to vaccine.

No Emergency Use Products, No School Mandates

Two final bills are HB205 and SB169. In the former, issues of emergency use authorization are addressed. Under HB205, a government entity may not require use of any medicines or vaccines that are not fully approved by FDA, are allowed under an EUA, or which are undergoing safety trials. Under SB169, no public body or school district shall require COVID-19 vaccination or condition any right or service on COVID-19 vaccination. And employees are exempt from employer medical treatment requirements if they have religious or medical reasons for their decision.

Transportation Already Protected

In May of 2021, Missouri passed SB46. Under this law, no entity in the state shall require documentation of an individual having received a vaccination against any disease for the individual to access transportation systems or services, including but not limited to buses, air travel, rail travel, taxicab or limousine services, other public transportation, or any public transportation facilities, including but not limited to bus and airport facilities

As all these bills show, there are many different ways to protect the public from unwanted medical interventions. And while COVID-19 vaccines are front and center now, we know the fight for health freedom in general will continue to be a major issue in the United States.

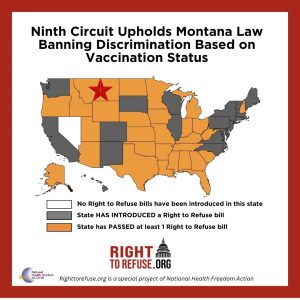

National Legislative Right to Refuse Campaign

The Right to Refuse National Campaign was launched in 2021 to help state organizations and grassroots advocates connect with each other for the purpose of passing state laws to protect the rights of individuals to make their own health decisions. RighttoRefuse.org is a special website to inform citizens of legislation being introduced and passed and the groups working at their state capitols that need your support.

To see the status of any current or passed Right to Refuse bills in your state, check out the RighttoRefuse.org website. In many states, the new legislative sessions will begin in the new year and bills have not yet been filed. If there are no bills showing in your state, be sure to check back often as we expect to see hundreds of new Right to Refuse bills filed in the majority of states across the nation over the coming weeks and months.

If your state does not already have a right to refuse campaign and you have a committed group of individuals wanting to change the laws in your state, the National Health Freedom Action team is here to help you. Please reach out to us via email at info.nhfa@nationalhealthfreedom.org to set up an exploratory conversation.

Now more than ever it is important that we use the tools that are available to us as Americans.

Your donation makes a huge difference in our ability to educate, foster, and mobilize with people like you in states across the country.

Together we can create the laws “we wish to see in the world.” Laws that protect our rights to make choices about our own health and the health of our children.

Donate by Credit Card, ACH or by mail

NHFA is a 501(c)4 lobbying organization, therefore your donations are not tax deductible.